In the realm of finance and portfolio strategy, yield optimization is a paramount objective. Within this dynamic landscape, the concept of convexity plays a significant role. Convexity refers to the curvature of a yield curve, which illustrates the relationship between interest rates and bond prices. Shifts in interest rates can lead to nonlinear movements in bond prices, creating opportunities for astute investors to maximize their returns. Advanced mathematical models are often employed to quantify convexity and identify investment strategies that exploit this curvature. By carefully considering the interplay between yield curves and portfolio allocations, investors can strive to minimize risk while targeting optimal yield outcomes.

Unveiling the Power of Convexity in DeFi

The decentralized finance (DeFi) landscape is dynamically changing at a breakneck pace, with innovative protocols emerging daily. Amidst this surge of innovation, one concept has garnered significant attention: convexity. Convexity, in essence, describes the curvature of a yield curve, and its implications for DeFi are both profound.

- By utilizing convexity, DeFi protocols can enhance their returns, leading to enhanced profitability for users.

- Furthermore, convexity can reduce risk by providing a cushion against market swings.

Understanding and utilizing convexity effectively is vital for DeFi protocols seeking to succeed in the long term. As the DeFi ecosystem matures, convexity will undoubtedly assume an even more prominent role.

Harnessing Returns with Convex Finance Strategies

Convex Finance presents a unique approach to augmenting your returns in the DeFi landscape. By exploiting its advanced protocol, savvy investors can maximize their returns across various platforms. Integrating strategic approaches within the Convex ecosystem allows you Convex Finance to master the complexities of DeFi and capture the potential for substantial rewards.

- Take note, concentrating your assets on high-yield pools can significantly increase your overall earnings.

- Moreover, the versatile nature of Convex Finance allows you to dynamically optimize your allocation based on market trends.

Ultimately, by adopting a well-defined approach to Convex Finance, you can unlock the full potential of DeFi and attain your financial objectives.

Navigating the Convex Universe: A Guide for Users

Embark on a thrilling journey through the depths of the Convex Universe with this comprehensive manual. Unlock the fundamental concepts that govern this dynamic realm. Explore hidden possibilities and conquer its complex systems. Our detailed guide will equip you with the skills necessary to excel in this novel territory.

- Decipher the puzzles of Convex physics

- Build connections with other users

- Modify your strategies to survive in a unstable environment

Position of veCVX in Decentralized Governance

veCVX plays a crucial position in decentralized governance ecosystems. By allocating voting power to holders, it promotes a more inclusive system where decisions are made collectively. This mechanism strengthens community participation, leading to more transparent and responsible governance frameworks.

- Moreover, veCVX incentivizes continuous loyalty to the protocol, as holders benefit from influence rights that are directly connected to their staked amount. This encourages a more robust governance system

- Consequently, veCVX has become an essential element of many decentralized protocols, influencing the future of blockchain governance.

Unlocking DeFi Potential: How Convex Finance Connects Yield and Risk

Convex Finance emerges as a influential player in the decentralized finance (DeFi) landscape, aiming to enhance yield generation while mitigating systemic risks. Its innovative approach leverages yield aggregators to dynamically allocate assets across various protocols, thereby increasing returns for participants. Convex Finance fosters a transparent ecosystem by integrating advanced risk management to ensure the durability of its platform.

Jennifer Love Hewitt Then & Now!

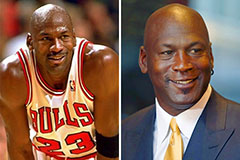

Jennifer Love Hewitt Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!